Deloitte Survey: Tokenization Transforms Traditional Finance

Bitcoin MagazineDeloitte Survey: Tokenization Transforms Traditional Finance A Deloitte survey reveals nearly all CFOs expect cryptocurrency integration, with 23% planning treasury use within two years, signaling a shift in traditional finance. This post Deloitte Survey: Tokenization Transforms Traditional Finance first appeared on Bitcoin Magazine and is written by Juan Galt.

Bitcoin Magazine

Deloitte Survey: Tokenization Transforms Traditional Finance

The tokenization of traditional finance is back in the news, as suits in boardrooms across the United States are discussing the benefits and risks of integrating cryptocurrency into their business. The term “tokenization” refers to deploying traditional financial assets on cryptocurrency rails, digitizing analog financial assets (including currency), and thus enable the financial industry to benefit from the speed and transparency that blockchains provide. But is this another crypto fad, or is there a fundamental problem that the young industry is addressing for the legacy financial world?

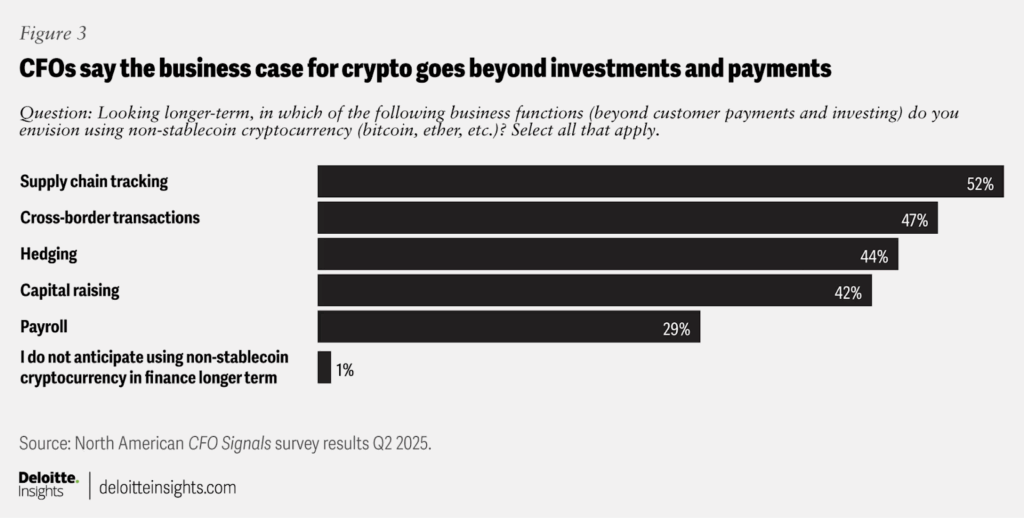

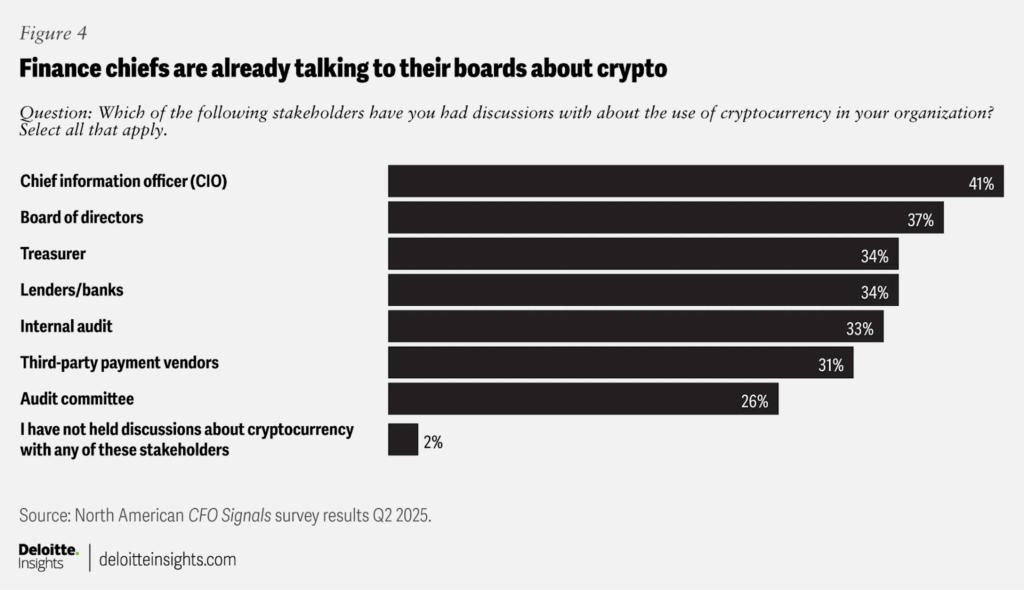

A Deloitte survey published in July polled 200 Chief Financial Officers working at companies with at least US$1 billion in revenues on the topic of tokenization. The survey showed that almost all CFOs expect their business to use “cryptocurrencies for business functions in the long term.” Only 1% of those polled said they did not envision it. And 23% said their treasury departments “will utilize crypto for either investments or payments within the next two years,” a percentage which is closer to 40% for CFOs at organizations with US$10 billion in revenues or more. Also, of those surveyed, only “2% of respondents said they have not had any conversations about cryptocurrency with key stakeholders”.

Tim Davis, a Principal at Deloitte told Bitcoin Magazine that there are two narratives making their way through American finance, “one is whether to have Bitcoin on the balance sheet and the other is a broader appreciation of tokenization’s future, which seems increasingly inevitable.” He added that “the first step is often stablecoins—how to adopt them, whether to issue their own coin. More corporates are having this broader strategy conversation today than those committing to Bitcoin on the balance sheet.”

Stablecoins in particular have captured Wall Street and Washington’s interest, as a tool that can serve the interests of the United States both at home and abroad. The survey reinforced this growing trend, showing that fifteen percent of CFOs expect their organizations to accept stablecoins as payment within the next two years, a percentage that is “higher (24%) for organizations with at least US$10 billion in revenue.”

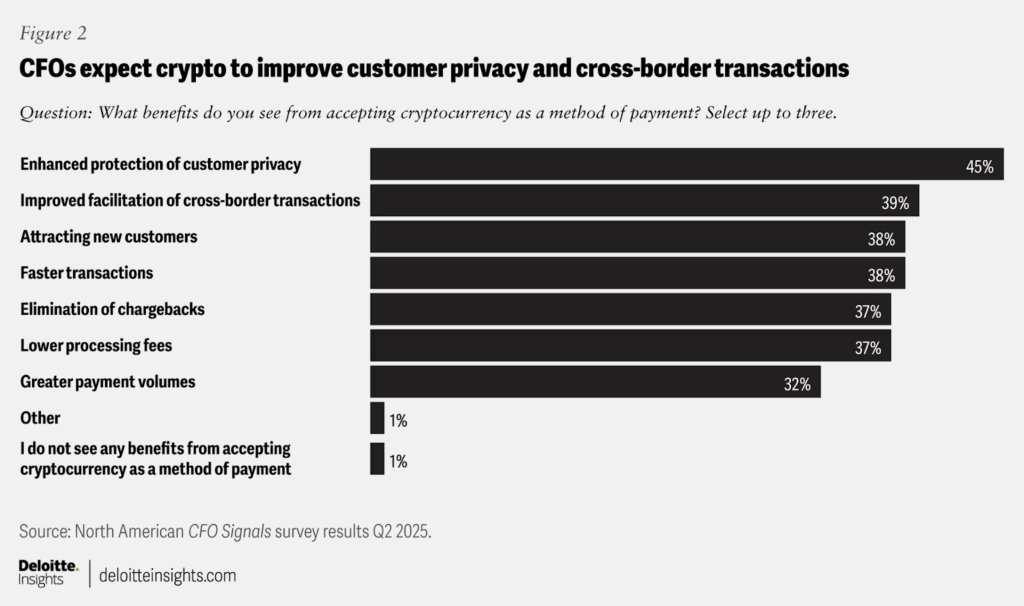

When asked about the benefits of “accepting cryptocurrency as a method of payment”, CFOs cited enhanced customer privacy as the most valuable _____, recognizing the massive damage done to user privacy by legacy know-your-customer (KYC) style data collection laws, and their unintended consequences in the digital age.

Davis says the financial industry is also tracking policy movements like “the SEC’s Project Crypto and similar efforts by the CFTC that are mapping out market structure.” He also mentioned the CLARITY Act, which “passed by the House and is under Senate consideration, bolstered by regulators as defining necessary structures” and which aims to provide regulatory clarity for crypto-related businesses, including tokenization-related operations. According to Davis, companies see this infrastructure transition as inevitable. “It’s likely a year out — and people are thinking about what it means for their business,” said Davis.

Davis added that “pre-COVID, blockchain was considered dead, but we’re emerging from that disillusionment. Capabilities have improved, the regulatory environment is better, and corporates see peers discussing this. Board members, often CEOs or CFOs from other companies, bring these strategic discussions back to their teams, spreading the inevitability of it, and the strategic choices needed.”

Step by step, the Bitcoin and crypto industry is merging with traditional finance, and the consequences are more profound than most people think. Terms like “tokenization” and “real world assets” or RWAs are often said in the same breath, almost treated as synonyms. But what does “tokenization” really mean for Wall Street and CFOs across America, and why are they so intrigued by it?

Davis says stablecoins and real-world asset tokenization are not about being trendy, reaching younger customers, or expanding into foreign markets, but they are about upgrading fundamental layers of the financial infrastructure, with new qualities like higher velocity of money, more privacy for users, while also increasing transparency and real-time data about transactions across the market.

What's Your Reaction?